Login

Contact

The Funding of the Future Now!

LET THE NUMBERS SPEAK

LET THE NUMBERS SPEAK

LET THE NUMBERS SPEAK

APP Benefits

Access Benefits

The global bond markets vary significantly in size, depth, credit quality and sophistication. Correspondingly, access to the capital markets also varies significantly and significant value and growth can be achieved if access can be improved.Process Benefits

There are several workflow inefficiencies in today’s workflows and meaningful cost and time savings can be achieved through its digitalisation …. but don’t let yourself be fooled …. This is less about savings than it is about the digital imperative!Price Discovery Benefits

We refer to price discovery benefits, when we can act as catalyst to achieve a more objective and data-based pricing of primary bonds. Price discovery benefits are also achieved by enabling a quicker and more reliable price-discovery data on which successful execution decisions can be made.Our Words

Roadmap to Future

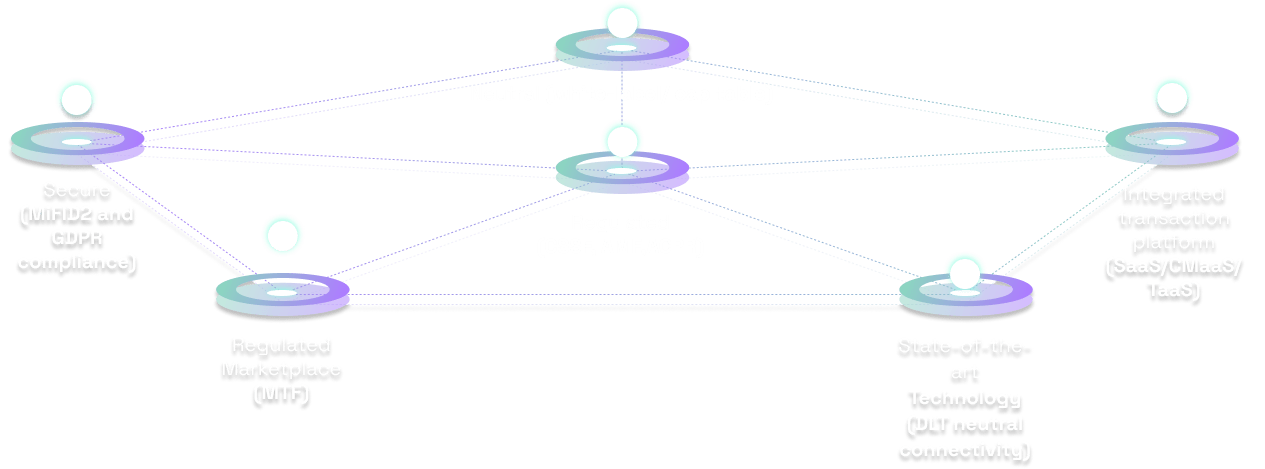

Strategic Objectives

Objective #1: Continuous Development

Objective #1: Continuous DevelopmentPursue and achieve client benefits through continuous development of our products

Objective #2: Inclusivity and Neutrality

Objective #2: Inclusivity and NeutralityPromote collaboration and seek to deliver the best digital customer outcomes for all by being inclusive and neutral and by offering easy-onboarding and connectivity to clients, partners and service providers

Objective #3: Expertise

Objective #3: ExpertiseNo compromises regarding level of required expertise in capital markets, regulatory matters and technology

Objective #4: Sustainability

Objective #4: SustainabilityApply sustainability considerations in all product development / solutions and activities

It's Happening!

What is the digital imperative?

During this digital transformation into a digital economy, it is important to clearly distinguish the dog and the tail and who is wagging whom.

We often hear that the debt capital markets work just fine and the sheer volume of successful issuance should be evidence enough to this effect. This may be the case for now, but to assume that any meaningful human economic activity somehow can continue without getting fit-for-purpose in a digital economy is just plain wrong.

In order to remain competitive, every single economic process and activity will need a digital response and those who decide to ignore this will fall behind. This is what drives the Digital Imperative. There really is no other viable choice.

With IoT, the amount of credit-relevant data in the economy will keep on growing exponentially and we believe that the link between financial instruments like bonds and the flow of operating data collected from real-world assets will become increasingly interconnected.

Now is the time to proactively engage and effectively influence the global primary debt markets in this transformation. Now is the time to ensure we achieve sustainable solutions that do good. The first step on this journey is to get the primary workflow and contact information into a format that stands a chance of interacting with this transformation. It is for this first step that we built the NowAccess, NowDocs and NowSpace module suite.